Payments for goods to be delivered in the future or services to be performed is considered unearned revenue. Any service performed in one month but billed in the next month would have adjusting entry showing the revenue in the month you performed the service. Aside from keeping everything neat and organized, adjusting entries is actually vital to your business if you want to keep an accurate record of your finances. However, adjusting entries looks different depending on the circumstance. This is why it’s crucial to understand the five types of entries before adding them to your journal.

Automate Adjusting Entries with Cloud Accounting Software

A business may earn revenue from selling a good or service during one accounting period, but not invoice the client or receive payment until a future accounting period. These earned but unrecognized revenues when are adjusting entries prepared are adjusting entries recognized in accounting as accrued revenues. Supplies Expense is an expense account, increasing (debit) for$150, and Supplies is an asset account, decreasing (credit) for$150.

What Are the Types of Adjusting Journal Entries?

For instance, an accrued expense may be rent that is paid at the end of the month, even though a firm is able to occupy the space at the beginning of the month that has not yet been paid. Accumulated depreciation refers to the accumulated depreciation of a company’s asset over the life of the company. On a company’s balance sheet, accumulated depreciation is called a contra-asset account and it is used to track depreciation expenses. For example, if you place an online order in September and that item does not arrive until October, the company you ordered from would record the cost of that item as unearned revenue. The company would make adjusting entry for September (the month you ordered) debiting unearned revenue and crediting revenue. The four types of adjustments in accounting include accruals, deferrals, reclassifications, and estimates.

Accrued Revenues

Recall the trial balance from Analyzing and Recording Transactions for the example company, Printing Plus. And through bank account integration, when the client pays their receivables, the software automatically creates the necessary adjusting entry to update previously recorded accounts. Manually creating adjusting entries every accounting period can get tedious and time-consuming very fast. At the same time, managing accounting data by hand on spreadsheets is an old way of doing business, and prone to a ton of accounting errors.

Thus, every adjusting entry affects at least one income statement account and one balance sheet account. The salary the employee earned during the month might not be paid until the following month. For example, the employee is paid for the prior month’s work on the first of the next month.

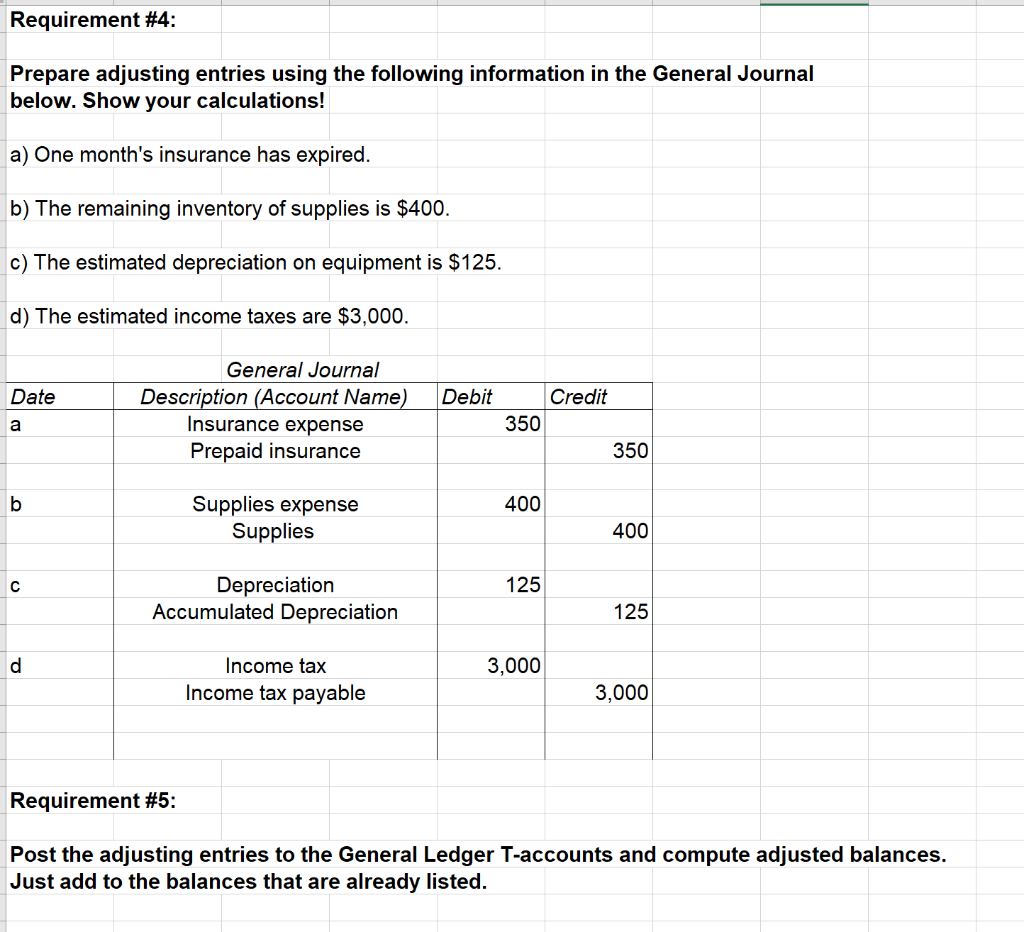

Here are descriptions of each type, plus example scenarios and how to make the entries. Following our year-end example of Paul’s Guitar Shop, Inc., we can see that his unadjusted trial balance needs to be adjusted for the following events. Accruals refer to payments or expenses on credit that are still owed, while deferrals refer to prepayments where the products have not yet been delivered.

- This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period.

- It is not worth it to record every time someone uses a pencil or piece of paper during the period, so at the end of the period, this account needs to be updated for the value of what has been used.

- Debits will equal credits (unless something is terribly wrong with your system).

- You cover more details about computing interest in Current Liabilities, so for now amounts are given.

Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax. This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax’s permission. Press Post and watch your fixed assets automatically depreciate and adjust on their own. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement.

The allocated cost up tothat point is recorded in Accumulated Depreciation, a contra assetaccount. A contra account is an account pairedwith another account type, has an opposite normal balance to thepaired account, and reduces the balance in the paired account atthe end of a period. Supplies increases (debit) for $400, and Cash decreases (credit)for $400. When the company recognizes the supplies usage, thefollowing adjusting entry occurs. The unadjusted trial balance may have incorrect balances in someaccounts. Recall the trial balance from Analyzing and Recording Transactions for the examplecompany, Printing Plus.

In February, you make $1,200 worth for a client, then invoice them. Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Recall the transactions for Printing Plus discussed inAnalyzing and Recording Transactions. We can break down steps five and six of the accounting cycle into a bit more detail. Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions.